Customer relationship management is a process in which a business or other organization administers its interactions with customers, typically using data analysis to study large amounts of information. Complex? Let’s simplify this, business is all about how the business generates leads, converts the leads into customers, sustains the customer and finally motivates the customer to add more leads which finally turn into customers. Customer Relationship Management (CRM) is the tool with the help of which this flow actually works.

What turns small ideas into large businesses? CRM, Let’s see how!

Businesses are all about the personal touches that the business creates with the customers. In smaller scales and at initial stages when there are very limited number of customers the business may be able to handle customers and their queries individually. But this practice does not sustains as the business grows and the number of customers increase. Also, this is the phase where the business has the opportunity to increase customers and in turn sales exponentially. This is aided by the leads that the existing customers create for the business on the basis of how the business has impressed them with their commodity and service. Here’s where the “real businesses” adapt the tool of CRM which helps them create leads and provides a useful tool for service management for the existing customers.

Components of CRM and How does Innoventry Software aids to it?

With the globalization and the domain of businesses reaching new highs every year with the introduction of e-commerce and franchise, it is quite difficult to keep touch with each customer on a personal basis. The CRM tool basically solves this issue and comes out to be an aid for the same. Not consuming much of your time, let me introduce you to all the features under the CRM application of the Innoventry Premium Edition.

Dedicated CRM Module integrated in the Software

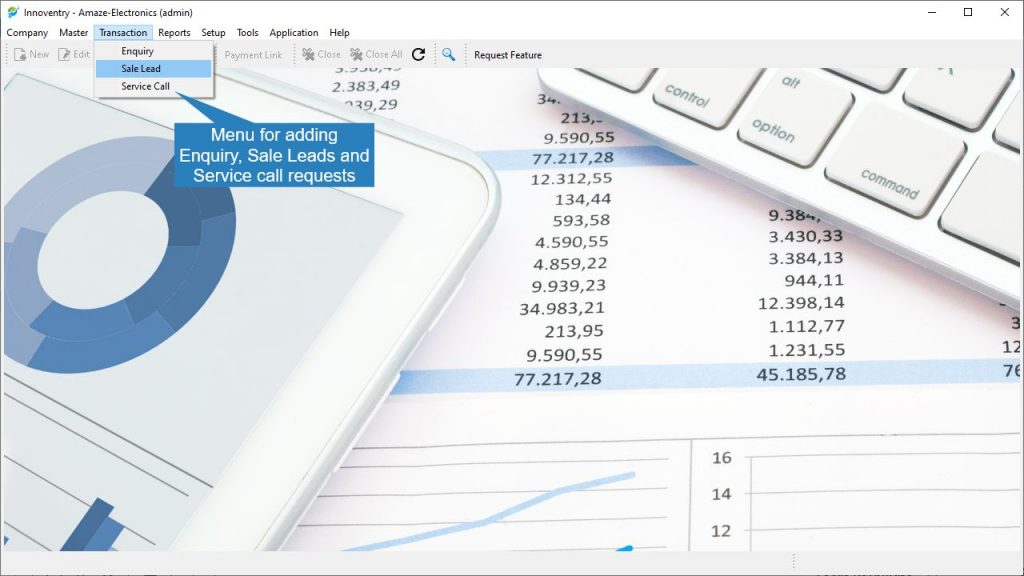

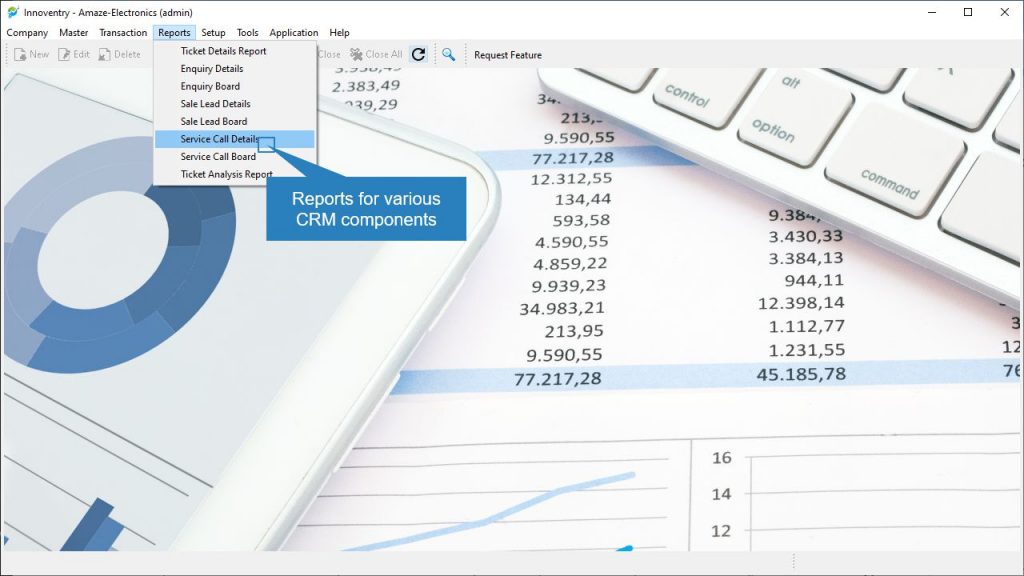

Isn’t it a plus point to have a CRM module for all CRM related jobs integrated in the software itself? Guess what! At no additional cost, Innoventry has included a dedicated CRM application which can be used to manage all CRM related components such as enquiries, manage sale leads and also manage service calls at one place. The interface is made super user friendly and very simple to understand so that it can be used by absolutely anyone.

Moreover reports for various components can also be generated and their status checked and updated at subsequent steps in the flow. The system generates reports which can be filtered using a range of dates. These reports never let you miss any customer’s query, sale leads and service call whatsoever.

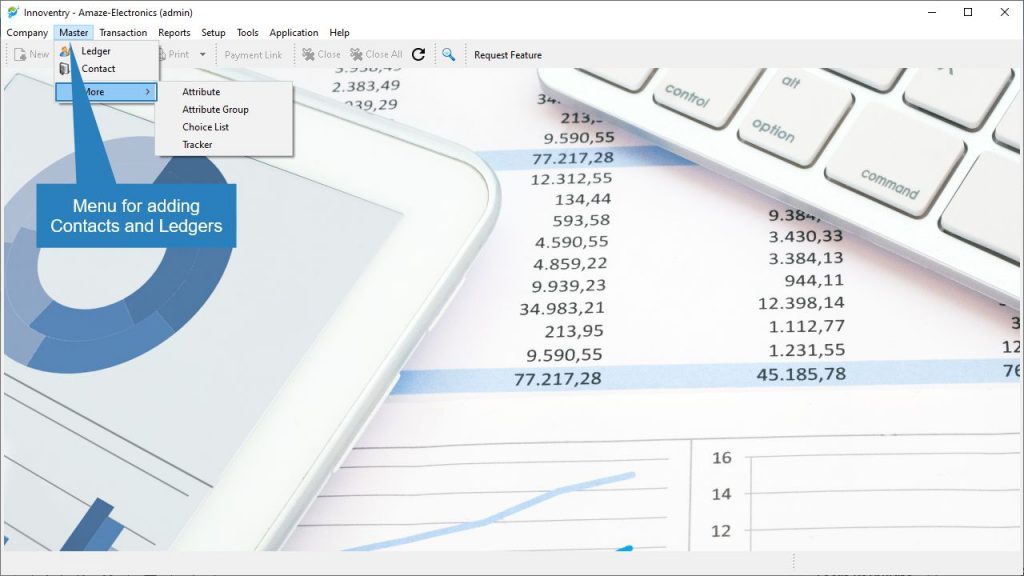

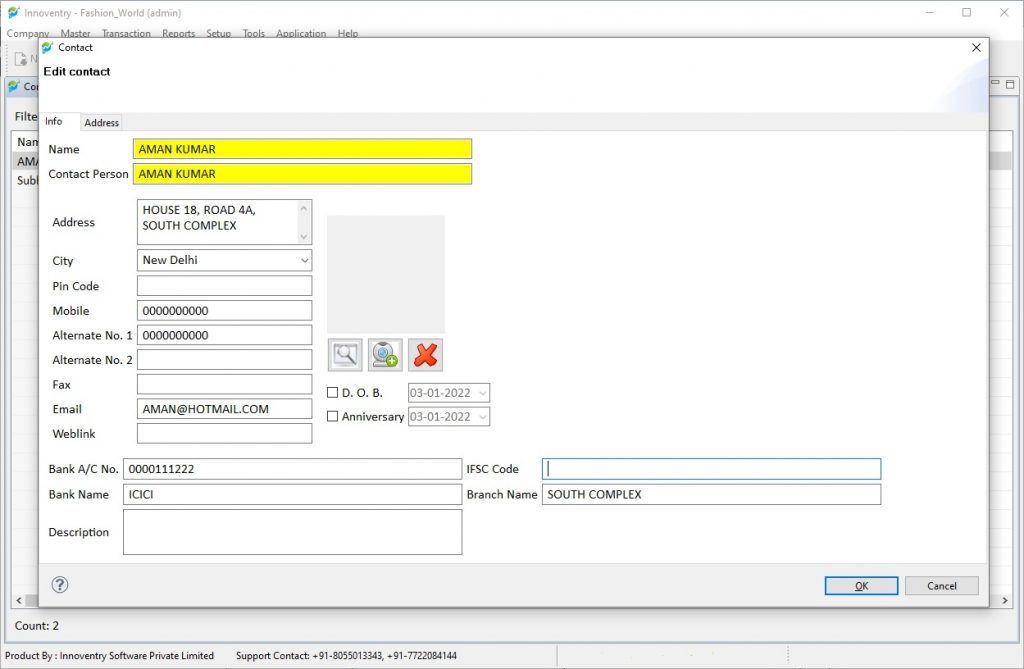

Contact and Ledger Management

It becomes a tedious job to insert the details of a particular customer again and again for various jobs such as billing, messaging in the billing and accounting software. A CRM tool creates the contact/ledger once, where the user can insert the detail just once and access it whenever required. Innoventry as a CRM Management tool creates the contact with all the details. These details can then be used for billing, sending promotional messages, keeping ledgers and other jobs as appropriate by just putting in the name of the customer. This reduces more of an administrative job for the seller and increases the selling efficiency and time management for the business.

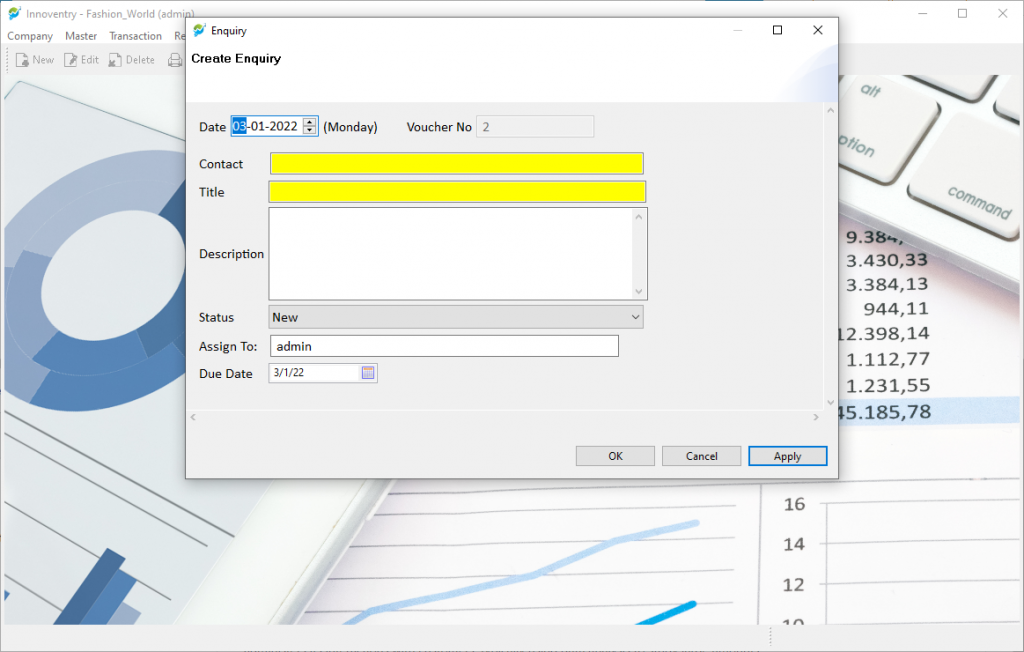

Management of Enquiries

A business always deals broadly with enquiries of Sales and Purchase. What are the commodities available? Which commodity is better suited? Do you have discount on such and such products? What is the return and refund policy for this product? And the list goes on and on… The earlier the customer gets response for these queries the better is the confidence build up of the customer on the business. But for this to happen, one must have the tool where the enquiries can be lodged and then follow-up of the query can be made with the competent authority/personnel. This is where Innoventry as a CRM tool helps you. Innoventry has options where the enquiries can be lodged and assigned to the concerned people accordingly. This can further be followed-up and can be addressed to subsequently using the query report options where all the queries and their status are listed. The response to the enquiry is not just fast with this but also organized in a way that you don’t miss any enquiry and henceforth a chance to generate another sales lead.

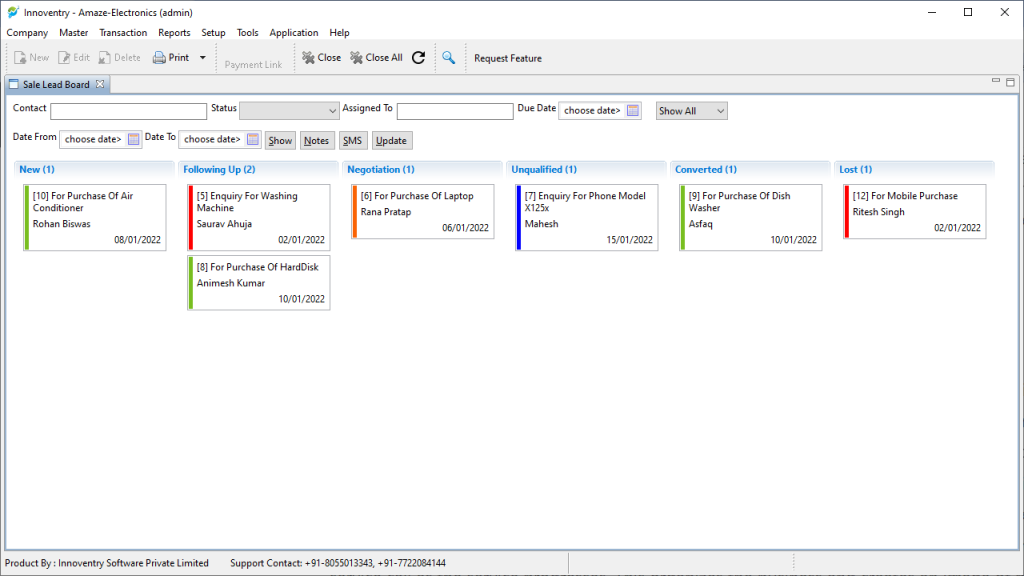

Sale Lead Management and Follow-ups

Sale leads as we all know as businessmen are the key factors in the profit making of a business. Sales Leads are generated by various ways such as leads from existing customers, leads from marketing, leads from advertisements etc. But there also must be a way these leads are contacted and followed up upon so that they are eventually concerted into customers rather than just leads. Innoventry as a CRM tool also helps to manage the Sales Leads. You can add sales leads, their contact details and then assign the sales lead to be followed up by the concerned people. The number of sale leads added and their details can be viewed using the reports options where the business can see how many sales lead were created and what is the status of the same.

The user can access all the sales lead and their status at one go under various sections using the “Sales Lead Board” feature in the CRM as seen in the snapshot above. The sale leads are highlighted with different color coding for easy reference. Leads highlighted in green color are the ones who are within their due dates, while red is for leads who have passed their due dates and blue for ones who are not qualified as leads. This way the business can focus on converting leads to customers in a more efficient way.

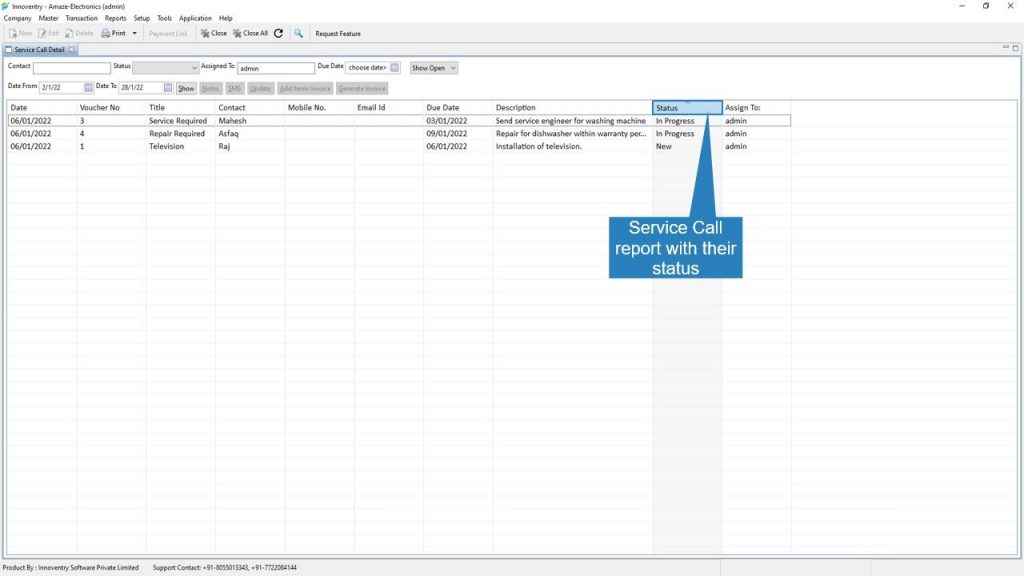

Service Call Management

Commodity is obviously the pillar of business flow but the services are also a prominent building block in a business. There are a number of businesses which require follow up services to be given to the customer such as, information on the use of the product and installation services etc. Electronics Appliance Shops are one such example of the same. To follow up upon these types of services Innoventry has included the feature of Service Calls in the CRM Module of the application. Using this feature businesses can add Service call logs into the software and then these can also be followed up subsequently until closure. The service calls has feature where the business can change the status of the service call as the service progresses. This organizes the business and creates an image of professionalism in the minds of customer for the business and helps to achieve better customer satisfaction levels.

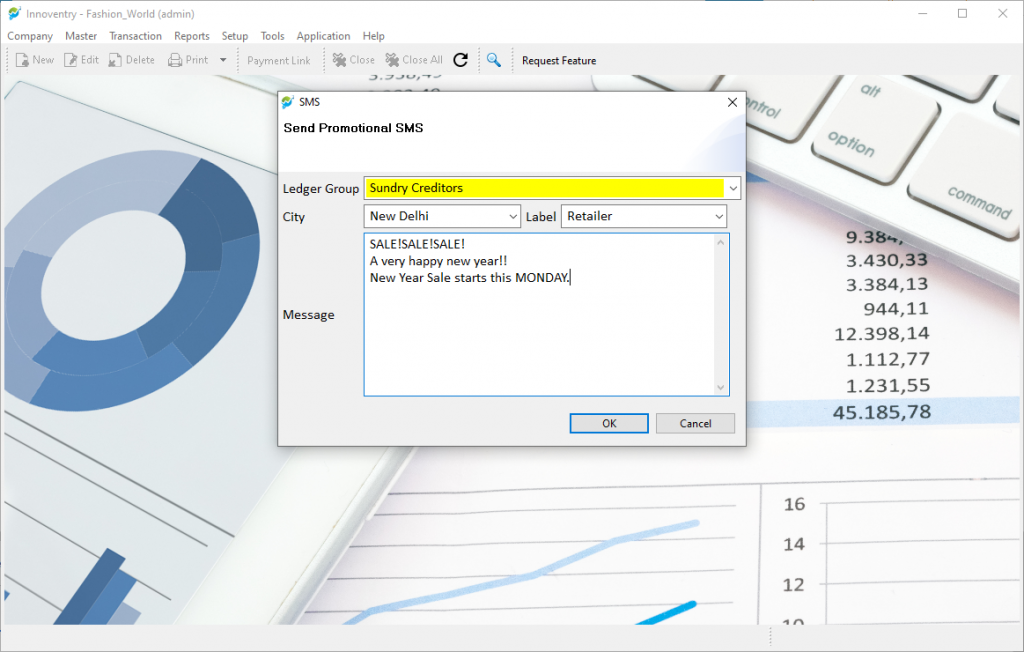

Promotional E-mails and Messages

Isn’t it a great option to send free promotional messages to attract your customers and leads by informing them about an upcoming sale or discount? This creates a buzz in the minds of the customer and they are well informed because of text messages. Every person has mobile phones in hand and are constantly seeing the notifications. The promotional messages are also addressed in a individualized manner and the impact is far more than any other means of promotion. CRM is not just about the queries and services of the customer but also how well informed the business keeps his customers. Innoventry realizing the same has incorporated feature where you can sent promotional messages to a very large number of people on their mobile phones with just a click of the button.

i-CRM Mobile Application

i-CRM is our mobile application available in the Google Play Store which is made to manage the sale leads and service call anywhere and anytime. Just with a tap on mobile screen users can create sales lead and follow them up accordingly. Out of office? No worries, create service tickets, assign them to users and then subsequently manage the status of the leads. We know how important is conversion of leads to customers in a business is. Let not time and conveyance be the obstruction in doing so. Manage your leads on the go and set due dates for them. Managing of leads is incomplete if we can not contact the leads, use the features in the i-CRM to call leads and convert them into customers eventually.

Features of i-CRM include:

- Create Sale Leads

- Create Service Tickets

- Assign them to users

- Manage status of lead

- Set due date

- Add notes to lead

- Call to leads

CRM as a tool helps businesses understand and address customer needs better by centralizing all their interactions and data from across different channels and departments. It also provides a wide range of tools to sales and marketing teams to streamline and optimize the entire sales cycle from lead generation to post sales support. A great CRM system helps you deliver great customer experiences across different channels and consistently drive growth. So choose your CRM Wisely.